Business Insurance in and around Granite Bay

Calling all small business owners of Granite Bay!

This small business insurance is not risky

Help Protect Your Business With State Farm.

As a small business owner, you understand that sometimes the unpredictable is unavoidable. Unfortunately, sometimes problems like a customer stumbling and falling can happen on your business's property.

Calling all small business owners of Granite Bay!

This small business insurance is not risky

Protect Your Future With State Farm

Protecting your business from these possible mishaps is as easy as choosing State Farm. With this small business insurance, agent Matt Copeland can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

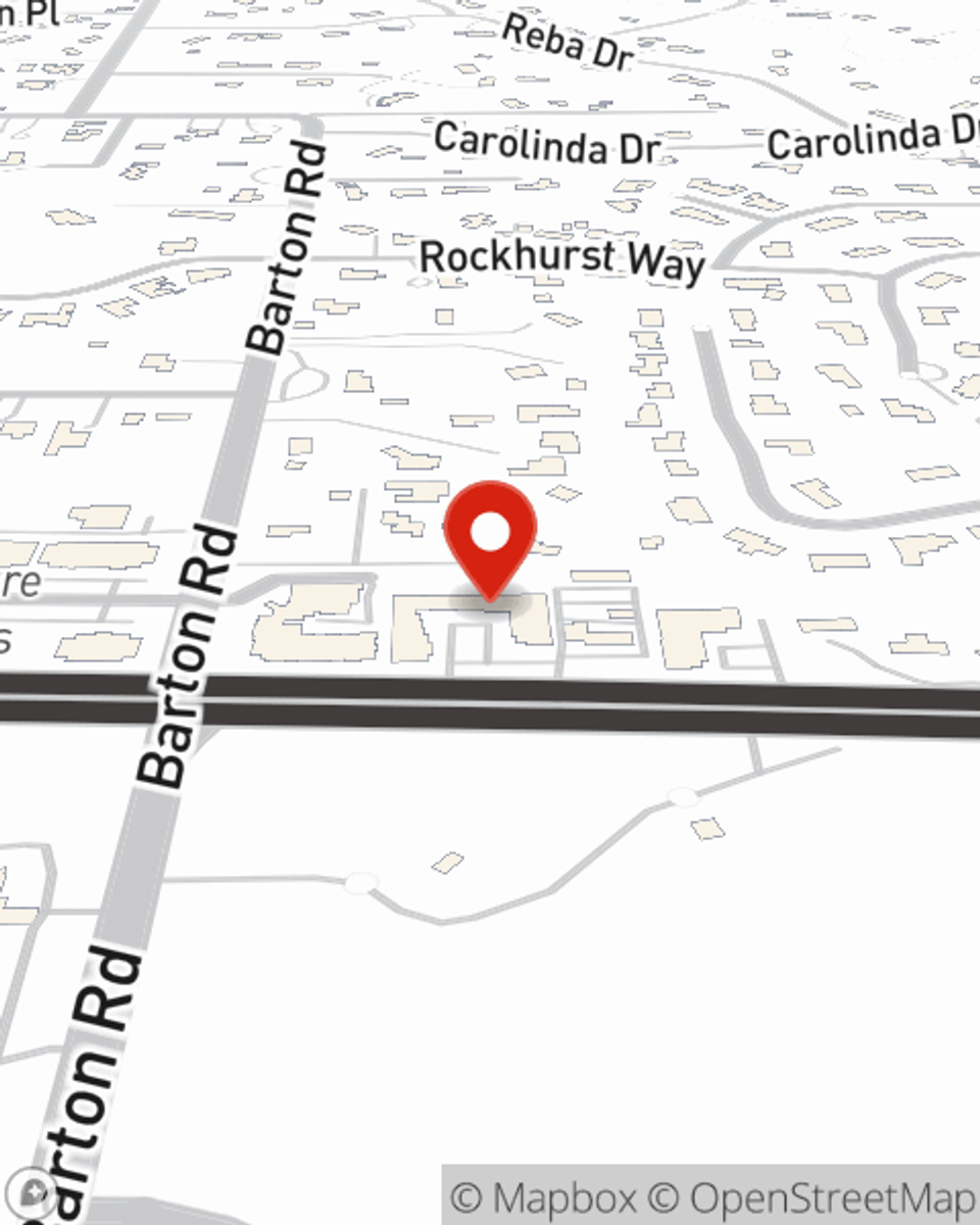

So, take the responsible next step for your business and visit with State Farm agent Matt Copeland to investigate your small business insurance options!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Matt Copeland

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.